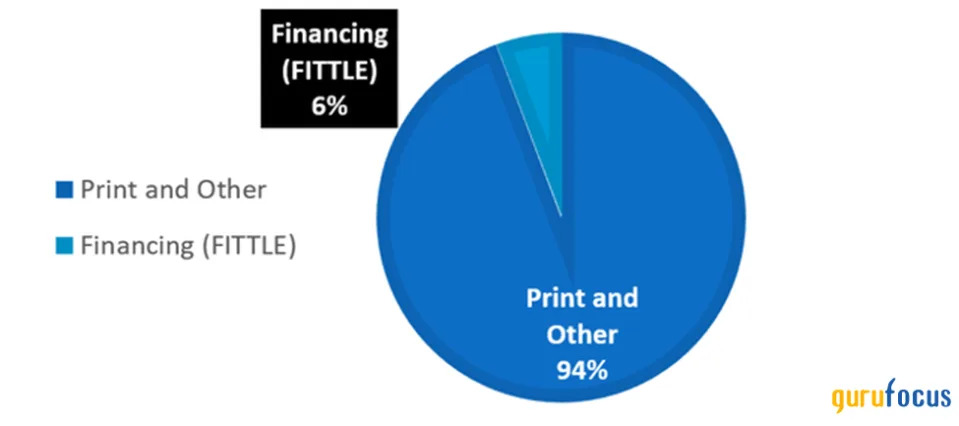

This analysis represents my coverage of Xerox Holdings Corp. (NASDAQ:XRX), which includes a deep dive into its business model, financials and growth strategy. From my research, I have set a strong sell recommendation on the basis that the company currently has significant exposure to the managed print services industry (accounting for around 94% of 2023 revenue) and my estimates that its diversification attempts into cloud, IT and digital services being unsuccessful due to the presence of more established tech companies with deep pockets, along with Xerox having no material contribution in its current revenue from this sector (no track record and significant execution risk).

Company description

Xerox is a leading provider of multifunction printers and managed document services catering to enterprise clients across North America, Europe, the Middle East, Africa and Latin America. Additionally, the company offers comprehensive information technology services tailored to small and midsize businesses, encompassing PC and network infrastructure, communication technology and network administration.

The company has two operating and reportable segments Print and Other and Financing.

The Print and Other segment focuses on the development, design and sale of document management systems, solutions and services. It encompasses a range of associated technology offerings, including IT and software products and services.

Financing, or FITTLE, is Xerox's financing solutions business. It primarily facilitates financing for the sale of equipment. Moreover, it extends financing options for non-Xerox office equipment and IT services equipment, enhancing accessibility for clients across various sectors.

Investment thesis

The company operates in a mature and highly competitive printer industry facing persistent revenue erosion and digital substitution risks. Despite its strong market position and brand recognition, Xerox is facing fundamental challenges that are likely to hinder its growth prospects. Xerox's revenue has been deteriorating year after year and it does not seem to have caught a break. After the initial shock of the pandemic in 2020, revenue is not even close to pre-pandemic levels (fiscal 2023 revenue represented only 76% of fiscal 2019 revenue, as shown in figure 2) and has no indications of doing so in the long term due to overall secular challenges, including declining physical print volumes (S&P expects printer unit growth to decrease 2% to 3% again in 2024 after declining about 2% to 3% in 2023).

Xerox's heavy reliance on the print segment exposes the company to this secular decline in demand for traditional printing solutions. Despite attempts to diversify into cloud and IT/digital services, the core printer business continues to face headwinds due to shifting consumer preferences and technological advancements. The secular decline in the print industry is mainly driven by decreasing paper usage, weak enterprise spending and subdued economic recovery. On the back of this, the company itself expects its revenue to decline 3% to 5% in 2024, and I expect this trend to continue in the long term (reflected in my valuation).

Figure 1: Dominance of print segment amid secular decline

Source: Xerox Investor Relations

Despite efforts to diversify toward emerging technologies, the company's recent reorganization saw the sale of its 3-D printer segment and announcements of layoffs of 15% of its workforce in January, raising concern. Moreover, Xerox's revenue decline has been somewhat sustained by its contractual post-sale revenues (historically accounting for 75% to 80% of total company revenue), which provide recurring revenue streams over several years. However, as this revenue stream diminishes with the decline of equipment sales (as shown in the chart below), I believe Xerox will increasingly struggle to maintain its financial position in the long term.

Figure 2: Deteriorating revenue since 2016

Source: Xerox Investor Relations

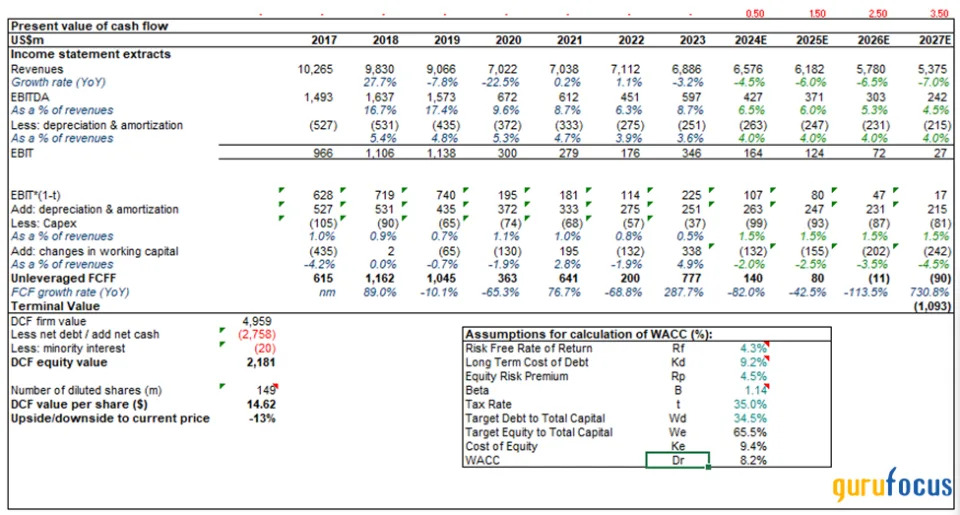

Valuation

Taking into account the issues Xerox faces, I have come up with a target price of $14.60 (down about 13% from current price levels) using a discounted cash flow valuation, which I believe is most suitable for the company due to the lack of direct competitors (peers have significantly diversified business models compared to Xerox Canon generates less than 50% of its revenue from the print services industry, whereas Xerox generated 94% as of fiscal 2023).

I included Xerox's deteriorating revenue and margins, mostly due to declining contractual post-sale revenues, secular decline and increased reorganization expenses. I have also assumed increased capital expenditures going forward as the company tries to diversify away from its printer-oriented business model to IT-specific service offerings.

I believe my assumptions and the subsequent valuation output accurately reflects the challenges Xerox is currently facing and the uncertainty regarding the transformation of its business model to a more sustainable one.

Figure 3: DCF valuation

Source: Xerox Investor Relations and my calculations

Risk factors

In my opinion, the primary risk factor to my recommendation lies in the execution of Xerox's business model transformation strategy. If the company can quickly transition its business model over the next three to five years, successfully gaining meaningful market share in cloud and IT/digital services to offset the reliance on print services revenue, it could achieve sustainable revenue growth, improve margins and expand free cash flow. However, I consider this scenario highly unlikely given the company's significant exposure to the print services industry and the significant competition in the sectors it is looking to diversify into.

Conclusion

In conclusion, I put forth a strong sell recommendation for Xerox due to its exposure to the declining print segment, ongoing revenue erosion and uncertain growth prospects. My recommendation and valuation reflect the uncertain path ahead as the company attempts to diversify its business model sufficiently to offset the challenges it faces in a rapidly evolving market environment.

This article first appeared on GuruFocus.