Researchers claim to have found the lost city of Atlantis on the bottom of the east Mediterranean, 80 kilometers southeast of Cyprus. The Cypriot government disputes the claim, saying more evidence is needed.

Researchers claim to have found the lost city of Atlantis on the bottom of the east Mediterranean, 80 kilometers southeast of Cyprus. The Cypriot government disputes the claim, saying more evidence is needed.

Researchers claim to have found the lost city of Atlantis on the bottom of the east Mediterranean, 80 kilometers southeast of Cyprus. The Cypriot government disputes the claim, saying more evidence is needed.

Researchers claim to have found the lost city of Atlantis on the bottom of the east Mediterranean, 80 kilometers southeast of Cyprus. The Cypriot government disputes the claim, saying more evidence is needed.

Cloud computing has numerous benefits for organizations in the healthcare industry, as many departments can find applications and data to host in the cloud environment, making resource provisioning easier and allowing employees to use less physical hardware to complete tasks. However, it is still common for some of these organizations to cite security as a major factor keeping them from adopting cloud services. With malicious attacks such as Heartbleed, Shellshock and a threat newly discovered by The Security Factory, it is crucial to pay attention to what is hosted in cloud environments and what security services are necessary to protect that data.

Cloud computing has numerous benefits for organizations in the healthcare industry, as many departments can find applications and data to host in the cloud environment, making resource provisioning easier and allowing employees to use less physical hardware to complete tasks. However, it is still common for some of these organizations to cite security as a major factor keeping them from adopting cloud services. With malicious attacks such as Heartbleed, Shellshock and a threat newly discovered by The Security Factory, it is crucial to pay attention to what is hosted in cloud environments and what security services are necessary to protect that data.

A Healthcare Information and Management Systems Society survey found that almost half of the respondents cited security as a key concern with cloud computing. Fortunately, only about 6 percent of the survey-takers told HIMSS researchers that they would not use a cloud service. The solution to working with sensitive information and applications in the cloud lies with security services. These partners can help reduce cloud computing concerns and allow IT departments to focus on protecting the organization's internal network to ensure security on all levels.

What goes into the cloud?

Before considering a cloud security service, organizations need to first understand that all applications do not belong in the cloud. By determining which programs and information can be stored in a public or private cloud, they will already reduce the risks associated with hosting Heath Insurance Portability and Accountability Act-compliant data.

Applications that are flexible in nature, which are programs that will see various amounts of users and data depending on the time of day, month or year, should be the first choice for cloud computing. On the other hand, data can and should be backed up or stored on cloud servers in order to reduce congestion on a local level, as some applications will need information transferred quickly and immediately, such as email, while others, such as user data, do not require fast and easy access.

While it is important to consider what will be hosted in a cloud environment, organizations should take full advantage of their cloud services. However, by only focusing on critical applications and data, the security risks of the cloud can be reduced and the security provider partner can dedicate even more resources to protecting that information.

Looking for a provider with access controls

A cloud security service is an ideal solution for healthcare organizations with large amounts of data in the cloud, preoccupied IT departments and HIPAA compliance requirements. The first aspect of cloud protection might be one of the most important: Limiting access for certain users.

With critical applications and information stored in the cloud, giving all employees access to everything could be detrimental. This also applies to providing and taking away access based on the task in which a staff member is engaging. The Security Factory, a Belgian cybersecurity firm, recently discovered a coding vulnerability that would allow a normal user to gain control over Windows-based servers through the creation of a directory name in any of the directories that the employee has access to.

Being a command-shell script, this vulnerability is very similar to Shellshock, and with correct placement, any user can cause malware to spread throughout a file server. Limiting employee access to servers hosting HIPAA-compliant data can prevent this, but many internal IT departments do not have the time or ability to constantly search for new vulnerabilities, while a cloud security firm will be up to date on new threats and able to patch them immediately.

Choosing the best technology

Another benefit of cloud security services is that they have the latest, cutting-edge technology. Finding a security firm with multi-tiered defense strategies will ensure that companies with high numbers of attacks will be safe. IT Pro Portal reported that with the best technology, coverage will include real-time threat monitoring, log management and denial-of-service attack mitigation. Firewalls will not be enough to stop constant threats that healthcare organizations face on a daily basis.

Additionally healthcare providers and companies will want a cloud security provider that is flexible. With innovations and trends in technology coming and going, it is crucial to have a service that can scale with the organization's needs. It can be hard to predict the future of cloud activity, and in this way security should be able to follow cloud infrastructure as it moves from being based on a public cloud to hybrid or from hybrid to private. A solution that is agile will reduce growing pains and allow the organizations to change in regard to demands.

Healthcare organizations are correct to be picky when looking for cloud solutions. Finding the best cloud host is just the beginning. By paying attention to those considerations, organizations can guarantee working with the best cloud security services for their needs.

David Bailey is Senior Vice President at Protected Trust.

Protected Trust is a sponsor of the Print4Pay Hotel. I urge members and readers to visit their site to see their full line of products and services. More and more we need to provide well rounded strategic solutions for our customers. Protected Trust offers some unique solutions that can help us in our day to day efforts. Check them out here.

I'm really excited to have these Print4Pay Hotel members on board as moderators. Our moderators will be there to post industry press releases, answer manufacturer product related questions, and drive content on the respective forums.

I'm really excited to have these Print4Pay Hotel members on board as moderators. Our moderators will be there to post industry press releases, answer manufacturer product related questions, and drive content on the respective forums.

In addition becoming a moderator also gives them the option to sell advertising on the Print4Pay Hotel site.

I'm excited for all of our members that we've covered these four additional major brands (Sharp, Canon, Kyocera & Konica Minolta). There is no where else on the web, where you can get real answers to your questions about hardware, software, features and solutions!!!

I'm not sure if they want their names mentioned here, so just take a trip to the forums, post a question and I'm sure your have a response in no time!!

Congrats guys and thank you for making the Print4Pay the best site for Imaging Professionals in the WORLD!!

Art

My turn for a rant!!!

It's late, I'm going to go through this rather quickly so please stay with me. I had an existing account that was shared with a Direct Branch. The Direct branch had the majority of the placements, while we had three units in a satellite office. One of those placements was a 135 page per minute production system.

It's late, I'm going to go through this rather quickly so please stay with me. I had an existing account that was shared with a Direct Branch. The Direct branch had the majority of the placements, while we had three units in a satellite office. One of those placements was a 135 page per minute production system.

I had been in touch with the manager about the end of lease and had a good relationship with him for eight years.

My guy told me that Direct would also be quoting for a new production system, since they also had a color unit at the same location. I knew my chances to hold the account were slim to none, however I put my best foot forward, submitted a very aggressive proposal 5 months before the end of the term (as did my competitor).

After hearing nothing for quite sometime I followed up with my guy. I was told that Jed in IT is making all of the decisions. My guy had heard nothing and suggested I follow up with Jed. He gave me his contact number and off I went.

I left my first call with a message that we submitted a quote and I need to follow up with him about the end of term obligations for the existing system and to get an idea of where we are at with the new lease. Waited a week, and nothing, placed another call a week later with the same message. Nothing.....no return call. A few days later the same message, of course there was no call back. All in all I placed at least 7 calls to Jed. I got nothing!!!! Typical I thought.

About a month later, I had a dream that I had lost the deal. Lo and behold the next day, I received notification from our service dispatch that he had received a call from "my guy" about removing the system. I thought, that SOB has my number and he couldn't call me? Then I thought that he didn't want to tell me directly because I would ask him "what happened"?

The next day, WTF, I get a call from Jed the IT guy. He's asking me for a copy of the cost per page lease, and looking to see if we can remove the equipment. I stated I would be more than happen to comply, however you need to call the leasing company and schedule that with them. However, I do have a question for you. "Why, did you buy from the other company", I was told it was a price thing. Ok, I can live with that, I then asked, "why did you not return any of my phone calls". The answer, "I'm not obligated to call anyone back". I blew my stack!!!!! We're an existing vendor and we wanted to tell you about the end of the lease obligations and you tell me you're not obligated to return a phone call? He went on to state that he doesn't check his phone because they are all sales calls! However, I do check emails. I thought, you rotten $#%!!!! I called this facility many times and you can't even get a person to pick up the dam phone, let alone find an or ask for an email address.

Thinking about it, you know what, I probably should have asked my guy for his email address also. But who knew that this worker was not obligated to call an existing vendor back.

Moral of the story, they entered into a new contract, because they didn't call me their cost per page lease went into a year roll over with some 2.5 million pages attached! I wish I could be a fly on the wall went that conversation took place that they now have to pay for two production systems for at least a year!!!!! But, I'm thinking they may just have the system forever, because their ineptness will cause them to fail to notify the leasing company when the renewal comes due again!

-=Good Selling=-

What's the Golden Rule when selling office equipment? Know your competition or least what they are quoting.

Ever notice every time you walk your dog that he or she stops at every tree, telephone pole and fire hydrant, ever wonder what they're doing?

They're checking out the competition. Who's who, whose doing what, who was here and where ya been! Amazing that dogs can find all of that out in a few whiffs .

We as sales people need to know the competition as well, what they're up to, what's their current maintenance pricing, leasing rates (did you know you can figure out the lease rate by backing out the payment), special promo's, or just how they are positioning themselves with the client. I just had a quote given to me a few days ago and there was some good value statements from a competitor that I'll change it up a bit and use for my quotes and proposals. Thus being able to read the quotes and proposals from the competition you may be able to tweak your proposal and borrow from others!

Here's some threads I've uploaded to the P4PHotel Message Boards, click the links and you'll be brought to the page.

Konica Minolta bizhub c654e pricing.pdf

Ricoh MP C305SP proposal quote.pdf

Sharp MX-M453N Pricing_Proposal.pdf

The Print4Pay Hotel includes boards for Ricoh Family Group, Kyocera, KonicaMinolta, Sharp, Toshiba, Canon, Muratec and Xerox.

-=Good Selling=-

Geesh, I should have written this the last week of September and not the first week of November! Well, it's still good and if you put these tips in practice you'll not wind up with the end of the year blues!

Ah, the last quarter of the year leads us to Halloween, Thanksgiving, Christmas and a host of excuses of why NOT to Buy! But, where this is a will there is a way to get to President's Club.!

1) Kick up your prospecting, don't dial it up a notch, dial it up BIGTIME and don't stop. Increased prospecting during the early months will give you the opportunities needed to sustain you during the excuse weeks of Thanksgiving and Christmas.

2) Ask and ye shall receive, there are many companies that will post a profit for the year and those companies may be looking to reduce their tax liability by making additional purchases before the end of the year. They won't tell you, you need to ask!!!

3) Focus on bigger takedowns, look for higher revenue opportunities. It's been stated that you can spend as much time closing a multi system segment 4 opportunity as you would a single segment 4 opportunity. Take special note of Production, Wide format and multi systems.

4) Explain your timeframe to your prospect, make sure there is no doubt with the customer that you are working a certain closing time frame. A customer asked me the other day, "why, should I do this now". I was honest and told him that it would help my end of year numbers and I would in turn help him with reducing their costs. One hand can wash the other!

5) Add extra selling hours to your quarter! Adding one hour a day for prospecting, researching, developing a quote, emailing or making calls will add twenty hours per month. That's 60 hours in a quarter, or a week and a half that you've gained over your peers!

Plain & simple, if you want it, you can do it!

-=Good Selling=-

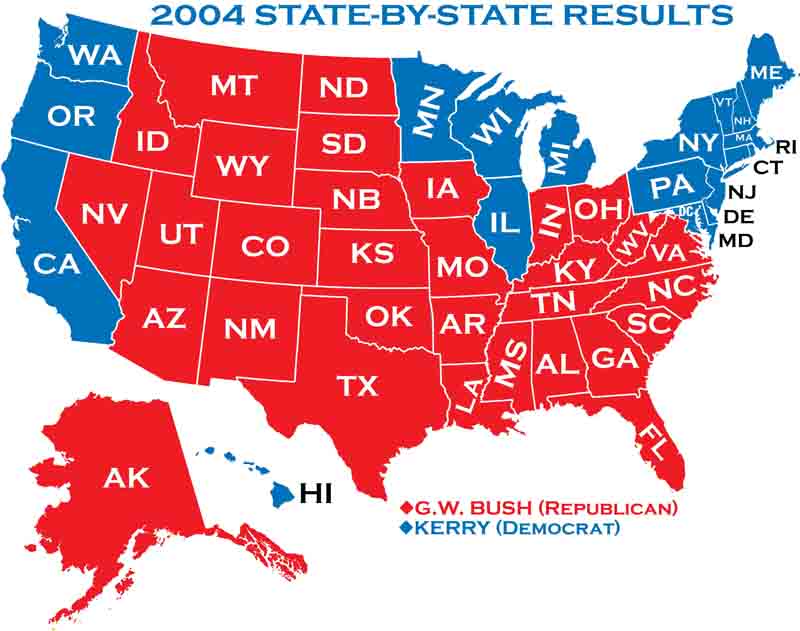

The United States presidential election of 2004 was the 55th quadrennial presidential election. It was held on Tuesday, November 2, 2004. Republican Party candidate and incumbent President George W. Bush defeated Democratic Party candidate John Kerry, the then-junior Senator from Massachusetts.

We'll go over what's worked for me with LinkedIn in the past 18 months. I've been using LinkedIn longer than that, but it's only during the last 12 months that I experimented with a few ideas that I had for LinkedIn.

As of right now I'm using the free version, however I expect to upgrade the lowest level of the pay version very soon.

1) Use LinkedIn every darn day, whether it's at night, at the beginning of the day or check the site from your mobile phone while on the road. This does not mean to check LinkedIn while you're driving!!!

Here you'll become familiar with "your wall", the profile page, the contacts page and the follow page.

2). Six degrees of separation is a theory that everyone and everything is six or fewer steps away! Believe it or not, originally set out by Frigyes Karinthy in 1929. I believe that with using LinkedIn you could only be 3 Degrees of Separation. Go through your contact list and take ten people that you are trying to connect with, search them on LinkedIn and I'd bet dollars to doughnuts that you know someone that is connected to them. You can then ask for an introduction from the person that is connected with them through LinkedIn or better yet, call your contact to see if she or he can help get and introduction.

3. Post your own Blog on LinkedIn. Start out with maybe one a month, and then increase to bi-monthly and then once a week. Write about something that is informative to your audience and don't come across like you are trying to sell something. You could do a short blog on "Why Do Checks That I Copy Come Out Black on the Copier", just and example but I hope you get the point. Write information that will help your customers and potential new customer garner knowledge about your solutions and or systems. Within a short period of time you can be the guru in your geo area, if not the world!!

4. Follow Companies on LinkedIn, take ten existing accounts that you are trying to get into. Search those ten accounts on LinkedIn to see if they have a LinkedIn page. I just searched on Print Audit, they do have a page. When you're on that page, you will see a "follow me" button. Click the button. Now whenever Print Audit posts anything on LinkedIn, you'll see it on your "wall" (home page). Now that you're seeing there threads, you will then "like" their threads and or drop a "comment" to their thread. A comment can be anything from congrats, or something that acknowledges that you are appreciative of the information.

In time, when you check your page for who is checking your profile, you will see that someone from that company checked to see who you are. You then have a warm contact, how you reach out to them after that is your choice.

5) Post links to newsworthy threads that you think your customers/connections can benefit from. They can be health related, business related. Try to post at least a few a week.

It's not about what you know, it's about who you know! Believe it or not your are connected to the people you are trying to connect with, you just don't know it.

Wait, wait one more, let's say you want to find all of the CEO's in Dover, Delaware. The in the advanced search bar of LinkedIn just type CEO, then the zip code and shorten the "within" to 10 miles and you'll see up to 10 pages of contacts with the free version of LinkedIn.

-=Good Selling=-

Email is a part of everyday life. It should come as no surprise, then, that it is widely used in corporate environments. Many believe that email will not be around for much longer due to the adoption of social media, text and instant messaging and other unified communication system features. However, a recent report from Osterman Research suggested the contrary, but also found that email will evolve in many ways to deliver increased ability to collaborate. The changing status of email calls for more security and protection of employees' personal information and corporate data.

Email is very much alive, as Osterman Research's study discovered that a typical email user sends an average of 30 emails during a typical workday and receives more than three times that. When expanding those numbers to a yearly level, the researchers identified that companies with over 5,000 employees send and receive more than 165 million email messages. Email is not even close to dying, as 52 percent of surveyed professionals stated that they send more emails now than they did 12 months ago and 44 percent of survey respondents told researchers that they dispatch the same number of emails compared to a year ago.

If email is used less, its contents become more important

Some organizations are trying to reduce their use of email in the enterprise environment. PC Magazine reported that the multinational corporation Atos made plans three years ago to reduce its need for email. The experiment worked, as the company decreased the number of sent and received emails by 60 percent. Rather than sending confirmations and asking enterprise-wide questions, email at the firm is only used for the most important tasks.

By reducing the number of emails, the importance of what they contain will increase - and, in turn, create challenges associated with protecting the information contained within. Atos CEO Thierry Breton told PC Magazine that the enterprise lowered the number of internal emails received per employee every week to around 25. Now, Breton stated that email is used for human resources and legal matters. The topic-specific reliance on email means that email encryption will not only be more common, but almost become a necessity.

The reliance on encrypted emailalso affects enterprises that do not reduce their internal email rates. The Osterman Research report found that email is used for sending attachments by 94 percent of users and for sharing files while on a call for 60 percent of users. This suggests that collaboration tools are falling by the wayside next to email. Because of email's prevalence in the average employee's life, it is far more productive, efficient and secure to send an email with an attachment than to upload a file to a database before emailing the respondent anyway.

Finding a middle ground between security and productivity

Whether business leaders decide to cut down on email or not, the effect that email has on business is profound. From collaboration to communication, email will stick around for a long time. However, as email's use becomes more focused on important business matters, the means to protect the documents and messages attached will only become more crucial to the short- and long-term success of an organization. After all, email encryption is already popular across healthcare and finance industries in which (HIPAA) Health Insurance Portability and Accountability Act compliance is required.

As encrypted email grows as an enterprise trend, security features need to be complemented by easy-to-use tools. This will ensure that employees remain productive while corporate and personal data remains safe. The best way to simplify email encryption would be through integration with existing clients. Employees will be less likely to forget to perform encryption and more likely to remain HIPAA-compliant during collaboration and communication with co-workers.

David Bailey is Senior Vice President at Protected Trust.

Protected Trust is a sponsor of the Print4Pay Hotel. I urge members and readers to visit their site to see their full line of products and services. More and more we need to provide well rounded strategic solutions for our customers. Protected Trust offers some unique solutions that can help us in our day to day efforts. Check them out here.

The above title is from a survey I published a few days ago on this site.

The above title is from a survey I published a few days ago on this site.

With the new MP C03 series color system, dealers have the option to buy a "smart operation panel", this operation panel would replace the existing operation panel that the system ships with.

The "smart operation panel" is pretty much a locked down (maybe not for long) android tablet. There are many benefits to the having the new smart operation panel for the end user, and the dealer.

At this point in time, when a dealer buys the new smart operation panel, there is no credit given for the old operation panel. The thought from Print4Pay Hotel members is that the old operation panel (which is still new), would then be discarded, saved in case one is needed in the future or forgotten about in a dealers inventory.

Which leads me to sustainability! We know that Ricoh is BIG on sustainability, BIG on the environment and BIG on conservation!

Which Leads Me to Questions:

Just seems like a BIG waste of resources for a company that care so much about the environment. Click here to take the survey. Should Ricoh Offer a Rebate for the old Color GUI for the MPC 03 series When Dealers Buy the New Smart Op Panel?

-=Good Selling=-

Why is there so much turn over in our industry? Is it that we're not hiring the right people, maybe we don't have the right training programs in place. Are we putting them in the field too soon, if so that means most are doomed for failure.

I don't have the answers to the high rate of turnover, however, I can give you a few points of why you will fail selling copiers. It's up to you to understand these reasons and make sure you avoid them.

So, there are just a few, if I had more time I could probably add another 5 or so.

It took me about two years in this industry before I finally figured out that in order to make the big bucks I needed to teach myself more about sales, and learn more about the products that I sell. I had to do this on my own time, because there was no one to mentor me when I first started. I survived the first two years because I had an excellent work ethic, and that was something that was drummed into me when I was a teenager. By the time I was in my early twenties, I knew how to "work", all I needed was the opportunity.

By, the time I was twenty eight I opened my own copier dealership and had that for 12 years before I sold it. Funny story about selling it, there were three partners, we all got married and thought it would be a great idea to let the wives work with us. BAD, BAD IDEA, and that was that!

Even now, there are days when I just don't feel like going through the grind. Matter of fact, I've had the ups and downs that many of us have faced through out the years.

It's all about what you want, are you willing to be undistinguished in your work, or do you want to excel and keep raising the bar?

-=Good Selling=-

The Boston Red Sox win their first World Series title since 1918—and break the "Curse of the Bambino"—by beating the St. Louis Cardinals 3–0 in the fourth game of the 2004 World Series of baseball.

The Boston Red Sox win their first World Series title since 1918—and break the "Curse of the Bambino"—by beating the St. Louis Cardinals 3–0 in the fourth game of the 2004 World Series of baseball.

Digging up leads for multi-functional devices can be trying at times, and especially if you're new to the business.

If you've just landed a position with a company that sells multi-functional copiers most likely you've been given a list of accounts to call on.

These accounts will consist of existing accounts and named accounts (accounts that you'll need to crack). With the existing accounts it will be pretty easy to book an appointment, but how about those "named accounts"? How the heck can you get passed the gate keeper to speak to Mr. or Mrs. Right?

You could make phone call after phone..... and this isn't a bad idea. My  personal approach is if you can't get them on the phone for reasons such as "just stepped out", "in a meeting", "out to lunch at 4PM", it's obvious they don't want to speak to you. Here are some of my fav tips for constant contact.

personal approach is if you can't get them on the phone for reasons such as "just stepped out", "in a meeting", "out to lunch at 4PM", it's obvious they don't want to speak to you. Here are some of my fav tips for constant contact.

1. Put them on a bi-monthly call, sooner or later you'll catch up with them.

2. Vary the times that you call, early (before 9AM), mid day, and then between the hours of 4:30 and 5:30PM

3. After you've made your first call to the DM and left a message, send them a letter in reference to why you are calling, and a letter of introduction. Make sure to mention of mutual accounts that they know or they do business with.

4. See if you can get the email address of the DM, if so, send one email and don't become a pain in the ass with multiple emails. Use the subject line of "Sorry I Missed You". This will get the email opened in most cases.

Here's a little trick I learned and it won't work for every account. After a few phone calls (not a large account), I couldn't get the name of the DM. I checked the web site and all there was a fill in box for the contact us page. In windows explorer I right clicked on the web page and then selected the "view source" code. I checked the code and wouldn't you know it, there on the contact page was an email address that I could use. Later that day, I found out this was the email address for the DM.

5. Send something different, be creative. Instead of sending a letter via regular mail, better yet send it via Next day delivery. It will get opened and plan a phone call for the day after the letter arrives.

6. If you have some promotional items, pack them up in a box and UPS them along with a letter, make sure you call them the day they get the package or a day later. I once sent a box of drinking glasses to an account, I followed up a few days later and I was able to secure an appointment. That appointment led to a sale months later of 9 copiers.

7. Go to LinkedIn and see if they have a page, if so look through their contacts to see who might be able to introduce you to them. Get familiar with who they know and who they do business with!

8. Schedule a drop off of some kind, I once ordered 100 plastic waste receptacles, had then inked with my company name, my cell number. I dropped these off with the brochure along with a note "here's a brochure about our latest system, if you're going to round file this, I also provided the waste receptacle for you". Point is, be different, get noticed, stand out in the sea of other sales people!!

9. Ask the gatekeeper what is the best time to call Mr. or Mrs. so and so.

10. If this is truly an account you need to crack, get there early and drop off a box of Joe and doughnuts. Sooner or later the DM will see the treats and ask where they came from. Is $15 to much to spend to have the DM pick up the phone? I think not!

The key is to be persistent, try to be the turtle, slow and steady will get you your appointment. Fast and furious will only turn the potential client off.

-=Good Selling=-

Security threats are growing in abundance as more health organizations choose to host large quantities of patients' personal and medical information in data centers, locally and across the country. A recent study from McAfee discovered over 31 million new samples of malware in Q2 of 2014 alone, bringing the total number of threats to more than 250 million. However, that is just malware. There are too many threats to expect a healthcare providers IT department to have the ability to prevent all of them.

Security threats are growing in abundance as more health organizations choose to host large quantities of patients' personal and medical information in data centers, locally and across the country. A recent study from McAfee discovered over 31 million new samples of malware in Q2 of 2014 alone, bringing the total number of threats to more than 250 million. However, that is just malware. There are too many threats to expect a healthcare providers IT department to have the ability to prevent all of them.

The lack of adequate security should come as no surprise. Community Health System recently lost approximately 4.5 million people's personal data. The worst part is that the data breach was caused by the Heartbleed bug, and the healthcare provider, let alone patients and employees, did not know about the vulnerability or attack until months later, after Heartbleed stopped generating media coverage. Now, many are worried that Shellshock will have similar consequences.

What is "Shellshock?"

Discovered about a week ago, Shellshock is the name given to a pair of vulnerabilities in Bash, a shell program found on Linux, Unix and OS X systems. InformationWeek reported that the exploit has a Common Vulnerability Scoring System score of 10, meaning that it should be taken very seriously. Additionally, the difficulty of exploiting Shellshock is considered to be low.

The result of both ratings has led to many hackers and cyberterrorists using Shellshock-designed malware at increasing rates. The Verge cited a report conducted by CloudFlare, a web-optimization company tracking the vulnerability, which said that the company alone has blocked approximately 1.1 million Shellshock attacks in its first week. The source also reported that attackers are sidestepping traditional computers and directly targeting Network Attached Storage devices, which are basically large hard drives commonly used in organizations' data centers. If successful, the cyber criminals can access any information on any devices connected to networks.

More bad news

While a patch for the source code was created, it requires users to apply it then recompile and redeploy the binary, which is hard for an average employee. That only applies to computers, however. InformationWeek reported that about 10 percent of personal computers run Linux or OS X, and many need to consider Shellshock's effects on the plethora of servers and Internet-connected devices used in hospitals and other health clinics. This applies to medical devices, cameras, network appliances and a lot more electronics. To fix those, the original manufacturers will need to send fixes as the scope goes far above an end user's knowledge.

Another problem is that the effects of Shellshock probably will not be immediately apparent, similar to Community Health Systems and Heartbleed. These vulnerabilities and malware are just the start of a new series of threats, InformationWeek reported. The source also noted that the healthcare industry is at the most risk to attacks like Shellshock and Heartbleed due to its reliance on embedded operating systems.

The cost of an attack could be massive if the results are anything like experts have seen with Community Health Systems. The alternative would be to replace all of the devices used in healthcare settings to prevent intrusions through the vulnerability. That is unlikely and could incur fees just as severe as an attack. Furthermore, many of these healthcare IT departments already have a lot on their plates with electronic health record system implementation, along with all of the other issues and concerns in the industry.

Two solutions

So, if replacing devices is costly, where do healthcare providers go from here? How do they prevent any Shellshock-based attacks? The first approach would be to seek out help from security experts. Finding a company that specializes in data center protection can go a long way toward preventing any similar threats in the future as well as ensure that NAS devices are protected from Shellshock in the short term. Those experts will have the know-how and ability to layer firewalls or set up proxies in an attempt to lead cybercriminals away from personal data.

Knowing that thousands of systems were vulnerable to Heartbleed, it should be expected that one intrusion attempt somewhere was successful. If Shellshock-based malware did happen to find its way into a healthcare provider's network, then having a security and data management service will at least give patients and employees peace of mind that another similar attack will not compromise any information or systems.

The other solution, which in reality should be combined with the former advice, is that IT administrators should brief other IT employees on improved security practices. InformationWeek reported that the U.S. Food and Drug Administration will be offering guidance to healthcare providers later this month and addressing the issue of Shellshock. So, in the meantime, it is important to ensure that steps are taken to protect medical devices from succumbing to attacks. If IT administrators do not know where to begin, they can even considering seeking advice from security organizations.

David Bailey is Senior Vice President at Protected Trust.

Protected Trust is a sponsor of the Print4Pay Hotel. I urge members and readers to visit their site to see their full line of products and services. More and more we need to provide well rounded strategic solutions for our customers. Protected Trust offers some unique solutions that can help us in our day to day efforts. Check them out here.

I picked up a connection on LinkedIn last week where the person was asking for advise about cold calling for copiers. Gesh, I thought this is right up my alley! I contacted that person and had them put the thread here on the forums section of the site.

I picked up a connection on LinkedIn last week where the person was asking for advise about cold calling for copiers. Gesh, I thought this is right up my alley! I contacted that person and had them put the thread here on the forums section of the site.

I posted one short response and am hoping that others will chime in to this thread. I then though about all of the cold calling threads we've posting over the last 11 years. Thus, I created a search link for cold calling. WOW!, there were more than 100 threads related to cold calling.

Many of these threads brings me back to the days before companies starting locking there doors and using access cards. Enjoy the threads below!!

Ten Tips to get the DM to Take Your Call "Selling Multifunctional Copiers"

100 calls a day, 240 minutes talk time a day, 4 opps per day

These are just a few of the theads, however, while posting these threads. I put a little more thought into how I've been conducting my cold calling in recent months.

My goal is to find out who the DM is for the office technology and that's about it, depending on the situation I may ask if that person is available while I'm there. At times if there is a company that is a paper intensive account, I will stop in while going to or leaving an appointment. But, for the most part, I have pre-planned cold calls. Those would be accounts that are already in my CRM and I've not been able to make any head way from my calls.

You need to make cold calling fun, be energetic, be fun, and have a sense of humor when speaking with the gatekeeper!

-=Good Selling=-

Access to this requires a premium membership.

A Premium Membership can carry you to the top of the sales ladder!

Premium Membership Includes:

Follow the link on the forums to get your Premium Membership. If you're interested in a lifetime membership please send me an email arthurkpost@gmail.com and we'll send you a pay pal invoice of $399 of a LIFETIME Print4Pay Hotel membership.